[ad_1]

Andrea Vumbaca/iStock by means of Getty Images

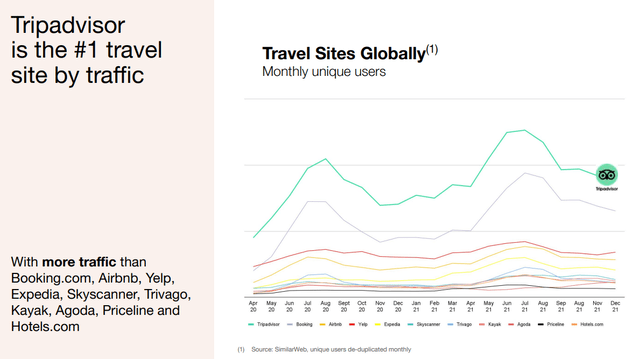

Tripadvisor (NASDAQ:Journey) is a corporation with so considerably opportunity. It is sad to see they are having so much difficulties monetizing the internet site. Unbelievably, it has more targeted traffic than even Scheduling.com (BKNG) or Airbnb (ABNB). Having said that, the company has struggled to locate the ideal business product to change visitors trying to find to read assessments into profits for the organization. Still, when low for the number of visits, the business does generate some income and functioning hard cash stream, and we think shares are now quite low-priced assuming vacation recovers in 2022.

Tripadvisor Investor Presentation

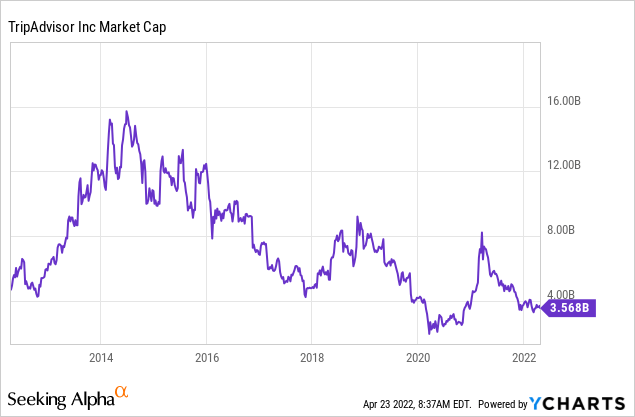

Tripadvisor is buying and selling with a industry cap that is barely ~3.5% that of Airbnb, which would make us consider that if the enterprise does not figure out the ideal enterprise model, then someone will likely offer to obtain them out and figure it out for them.

Administration tried out to correct the monetization issue by presenting a subscription support known as Tripadvisor In addition, but so significantly it has not really satisfied anticipations. The subscription, which presented up-entrance hotel bargains to subscribers for $99 per calendar year, ran into stiff opposition from big hotel chains about level parity challenges. It is currently transitioning to giving considerably less attractive cashback payments immediately after stays.

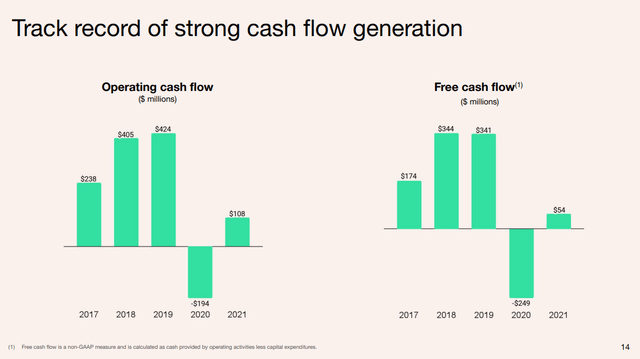

Pre-pandemic Tripadvisor was capable to crank out additional than $400 million for every yr in functioning hard cash movement, and more than $340 million in absolutely free hard cash move. Evaluating these figures to the present market place cap, we see that the firm is hardly buying and selling at ~10x this income flow number. If there is a whole vacation restoration, the company should really in theory be equipped to deliver even much more income and absolutely free money move, specified that it took out additional than $200 million in expenditures from its price tag construction just after the pandemic, and has claimed that a major portion of these personal savings must keep on being article-recovery.

Tripadvisor Investor Presentation

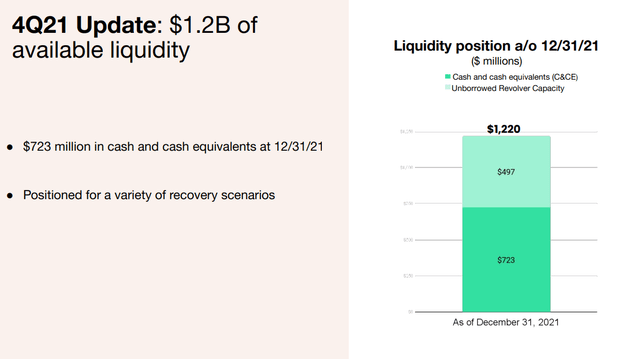

Luckily, the enterprise has plenty of liquidity to wait around for the vacation recovery to get there, even if it is not in 2022, but in 2023 or 2024 as an alternative. Tripadvisor has additional than a billion bucks of liquidity involving funds and equivalents, and unborrowed revolver capacity.

Tripadvisor Investor Presentation

Valuation

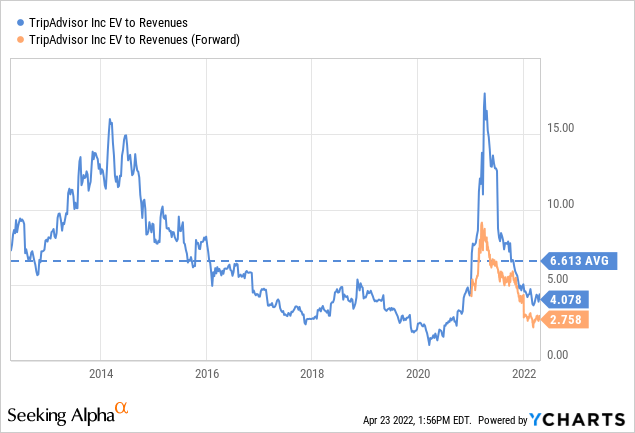

We can see how very low the valuation has gotten by looking at the EV/Revenues several and evaluate it to its historic average. This many is additional than a third under the average, and the ahead a number of is much less than 50 percent this historical regular.

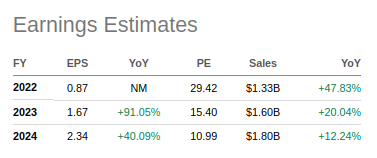

Analysts are expecting earnings to significantly maximize in the upcoming few of a long time. The ordinary estimate for FY24 is at this time $2.34, which provides an FY24E P/E of 10.9x.

Trying to get Alpha

Advancement and possible catalysts

There is expectation that in 2022 journey will have recovered to 2019 stages, greatly benefiting the corporation. Particularly, as we described, many thanks to the costs it took out correct after the pandemic started. The firm expects these discounts will continue even right after a comprehensive restoration. This ought to make the organization additional worthwhile than it was pre-pandemic.

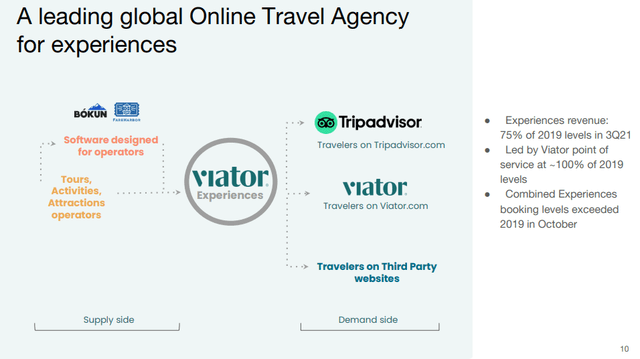

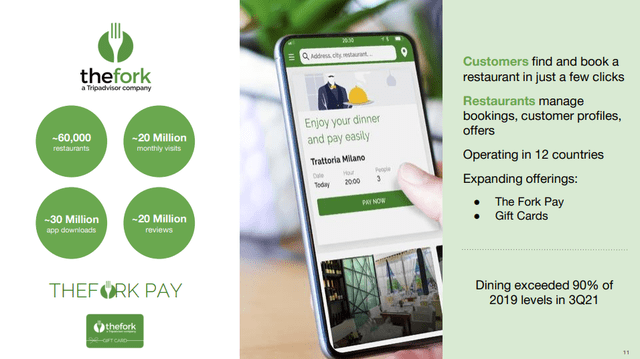

There are other potential catalysts to unlock price over and above a possible takeover. A person would be a successful re-made membership support. Whilst the first attempt at Tripadvisor In addition experienced problems, the firm is seeking to modify the merchandise and to relaunch soon. Two other progress segments are Viator and LaFourchette. Viator is the primary market for travel encounters and has been rising at a pretty very good rate. LaFourchette is a cafe reservation application that operates typically in Europe, comparable to OpenTable in the US market. The two of these companies have observed a a lot quicker restoration than the most important Tripadvisor Resort business. Tripadvisor is also considering advertising to public shareholders a minority stake in Viator, with Tripadvisor retaining command of the brand name. This could unlock some value and display traders how substantially this business enterprise is worth to the business. Tripadvisor previously submitted a private S-1 draft registration assertion with the SEC.

Liberty TripAdvisor Trader Presentation

Rivals GetYourGuide and Klook have been valued at extra than a billion pounds, so Viator could surely go the needle for Tripadvisor. Especially taking into consideration that Viator is considered the chief of the booking ordeals sector. Encounters reserving amounts exceeded 2019 levels in October 2021.

Liberty TripAdvisor Trader Presentation

TheFork (LaFourchette) operates in 12 nations and partners with ~60,000 dining establishments to take care of reservations for them. It is a different Tripadvisor enterprise that is developing rapidly and at some issue could also be regarded as for an IPO, a spin-off, or a sale.

Liberty TripAdvisor Trader Presentation

Conclusion

Tripadvisor shares are actually low-cost, particularly if a entire vacation restoration comes before long. With the expenditures that have been taken out of the organization, it has the likely to be much more lucrative than right before, and the enterprise is experimenting with techniques to greater monetize its large website targeted traffic. There is also the chance that it may well come to be an acquisition concentrate on from a further organization that has some strategies on how to monetize all the visits it receives. There is also a large amount of value in some of the other organizations Tripadvisor holds, these types of as Viator and TheFork.

[ad_2]

Resource link

More Stories

Finding A Hotel Tonight Is Easy If You Read This First

Best Hotels in Boston Overview: Recommendations for Nice Hotels Near Popular Attractions

Travel Tips For Barbados – Hotels